Clyde Hill News: Clarifying property tax proposals

Also: Many more state housing law proposals; Bellevue PD to deploy body cams, tasers

This week, a closer look at the impact on Clyde Hill residents of the state senate bill that would permit Clyde Hill and other cities to raise property taxes by more than the current 1% per year limit.

The short version: the impact on Clyde Hill residents of a 1% increase in the city’s property tax is, on average, ~$12 per household. Any increase in local property taxes levied by the city of Clyde Hill requires approval of the city council.

More detail on this topic and the churn in proposed state housing laws, below. But first: Bellevue Police will deploy body-worn cameras and tasers, according to the Bellevue Police Department’s blog (link):

The addition of body-worn cameras to Bellevue’s police department equipment is the culmination of years of preparation. The department engaged the community and its community Police Advisory Councils in 2021 and offered additional information about the technology on EngagingBellevue and the department website.

Also:

The Bellevue Police Foundation contributed to the purchase of this new gear through a donation to Bellevue Police. The foundation is a 501(c)3 nonprofit whose mission is to foster community support to fund equipment purchases, training, and public recognition for officers in the Bellevue community.

If you’re interested in talking with other residents putting together a Clyde Hill Police Foundation (link), please let me know and I’ll connect you with them.

Disclaimer: while I am a councilmember on the Clyde Hill City Council, I write this newsletter in my capacity as an individual resident. Any opinions expressed are my own and not necessarily the position of the city. City information and references here are from public sources. I welcome email responses — and if the topic is about city business I will respond from my city email account.

Property taxes: Lost in translation

Briefly: communication from the city to Clyde Hill residents about property taxes has lots of room to improve.

Last week, I wrote that state lawmakers are considering raising the current 1% limit on property tax increases and that Clyde Hill’s administration signed on to a coalition lobbying effort in support of this increase (link).

Below, detail from many conversations digging into the topic. At a high level:

The impact on Clyde Hill residents of a 1% increase in their city property tax is, on average, ~$12 per household.

Any increase in local property taxes levied by the city of Clyde Hill requires approval of the city council.

Less than 5% of what Clyde Hill residents pay in property taxes stays in Clyde Hill to pay for city services.

The rules of endorsement could be a lot clearer.

The impact on Clyde Hill residents of a 1% increase in their city property tax is, on average, ~$12 per household.

Clyde Hill collects ~$1.3m in property taxes from its residents. A 1% increase results in an additional ~$13,000 cost to residents. Across the ~1,100 households in Clyde Hill, the impact works out to $12 per homeowner, on average. For people who like math, here’s the King County Property Tax Levy Worksheet from the November 28, 2023 city council meeting: link.

If state lawmakers enact the proposed law (SB 5770) and the mayor and city council agree to raise city property taxes by 3%, the total impact on residents would be (on average) $36 per household.

Any increase in local property taxes levied by the city of Clyde Hill requires approval of the city council.

Clyde Hill residents see their property tax bills go up for a variety of other reasons. For example, properties in Clyde Hill have appreciated faster than many other properties in King County. Also, voters have approved additional levies (for example, to benefit Bellevue schools and green initiatives in King County).

Less than 5% of what Clyde Hill residents pay in property taxes stays in Clyde Hill to pay for city services.

Here’s the pie chart of where Clyde Hill residents’ property taxes go:

Note the small slice — less than 5% — that goes to Clyde Hill from what residents pay.

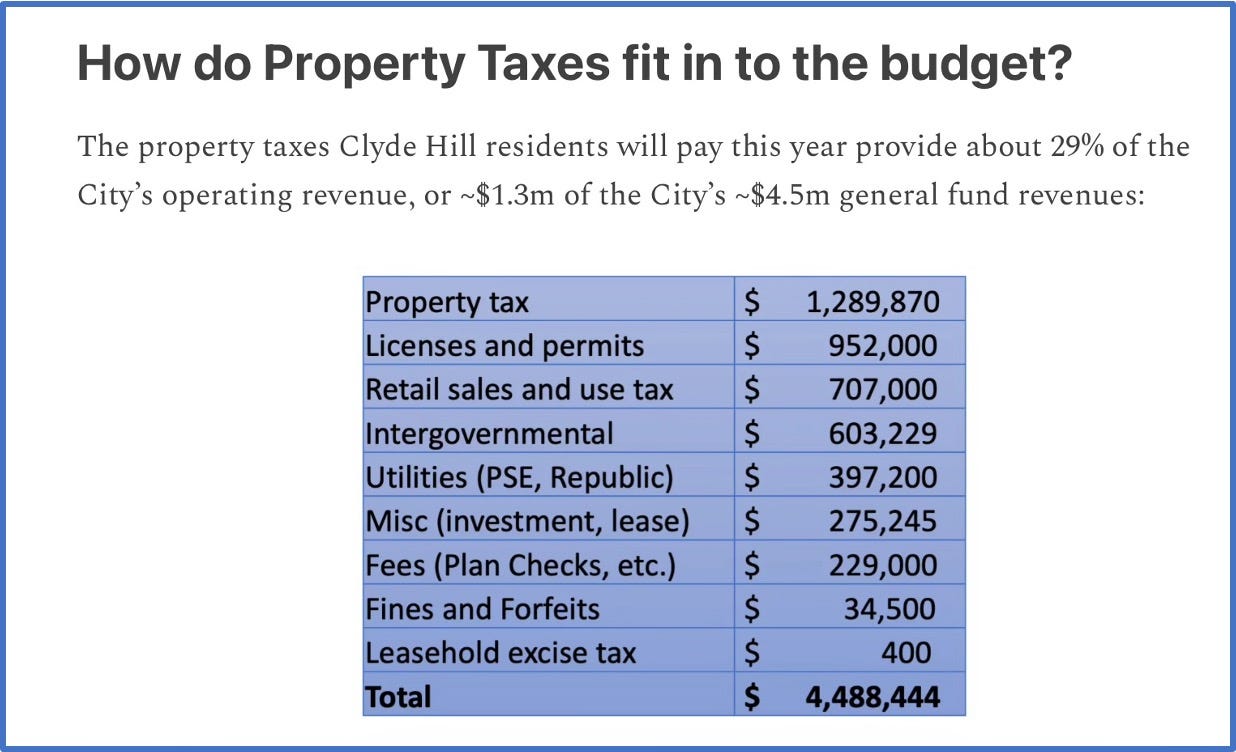

That small slice actually represents a big slice (~30%) of how Clyde Hill funds its operational budget. From a previous newsletter (link):

The rules of endorsement could be a lot clearer.

It’s not clear from Clyde Hill’s website what the rules and procedures are for elected or appointed officials to endorse a proposed law.

For context, “more than 150 city officials representing over 90 cities” signed the letter (link) from the Association of Washington Cities in support of revising the 1% cap on raising property taxes, including Clyde Hill Mayor Steve Friedman and Yarrow Point Mayor Katy Kinney Harris, as well as council members of many other cities.

It’s worth noting that the city council unanimously approved the city’s “2024 Legislative Priorities” (link) in November 2023, including an item about “replac[ing] the 1% property tax cap with one that takes into consideration inflation and population growth.” There was no specific discussion of SB 5770 specifically.

Given that there are three new council members since that November vote, perhaps a good practice in future years would be to hold off discussion of legislative priorities until the new council is sworn in.

State housing law churn

Briefly: it’s unclear which of the many additional changes to housing laws that state lawmakers are considering — and would affect Clyde Hill — will become laws.

For example, the “lot splitting bill” I wrote about in January (link) appears unlikely to become a law, according to the Association of Washington Cities.

Some of the new proposed laws radically reduce local control of land use and zoning. For example, a proposed “Housing Accountability Act” (HB 2113) would

“push local governments to increase housing production, especially those that have set up a regulatory gauntlet to restrict homebuilding,”

“force resistant jurisdictions to allow apartment construction,” and

make cities “demonstrate to the state that they’re fully in compliance with… [enabling] housing that is ‘affordable to all economic segments….’”

according to The Urbanist (link).

Clyde Hill is working through finishing its state-mandated Comprehensive Plan before moving on to bringing the city’s land use code into compliance with new state housing laws.

Thank you for reading! Please forward and share with your friends and neighbors, and if you are not already getting this newsletter, subscribing is both easy and free.

Dean Hachamovitch