Clyde Hill News: Property tax increase on the April Ballot

City seeks council approval for $779K remodeling project; update on budget deficit plan expected April 17

This week’s newsletter breaks down Clyde Hill residents’ property tax bills — what is under residents’ control and what isn’t — in the context of this month’s ballot measure to “authorize an additional property tax for seven years beginning in 2026:”

Also, the city will hold its regular council meeting on Tuesday, April 8th, at 6:00 PM as well as a budget meeting on Thursday, April 17th, at 4:00 PM.

Agenda items include a staff recommendation to move ahead with a $779K construction contract to remodel the city’s public works shop.

According to the staff memo, “This amount exceeds the amount budgeted and therefore would require a budget amendment.” (link)

On the budget front, the city set expectations that staff will

“deliver an updated projected budget at the April 17 meeting, one that would include recommendations to reduce, and potentially eliminate the projected 2026 budget deficit.” (link)

The complete agenda for Tuesday’s meeting is available here: link.

Disclaimer: while I am a council member on the Clyde Hill City Council, I write this newsletter in my capacity as an individual resident. Any opinions expressed are my own and not necessarily the position of the city. City information and references here are from public sources. I welcome email responses — and if the topic is about city business I will respond from my city email account.

Breaking down property taxes

Briefly, Clyde Hill’s 2,300 or so voters have some control over ~4.5% of their tax bill: what the City of Clyde Hill collects.

The rest of their property tax bill reflects actions from other taxing authorities: Washington State, Bellevue School District, King County, the King County Library System, Sound Transit, and the Port of Seattle.

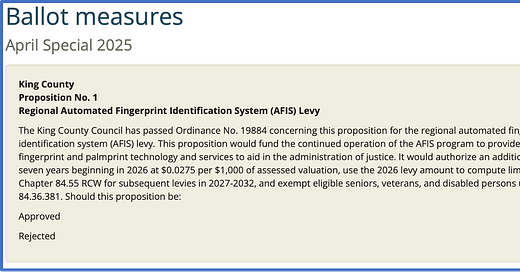

This month’s ballot measure will result in property tax bills going up next year by $27.50 per million dollars in assessed value, if King County voters pass it. The measure involves funding the continued operation of the regional automated fingerprint identification system.

What residents can control

Each year, the city is permitted to increase the amount of the property tax levy it collects by at most 1%. A city may ask its voters to authorize an increase of more than 1% to the property levy amount. (link)

For 2025, the amount of the city’s property tax levy was $1,369,379 (link).

While individual house and land values might go up or down any given year, the total amount of property tax the city collects from property owners is fixed.

“Taxes on individual homes could increase by more or less than 1% depending on how they change in value relative to other properties,” according to a document from the Department of Revenue that walks through the calculations. (link)

About the library

Clyde Hill residents pay for and have privileges with the King County Library System because residents voted for it in 1992:

The towns of Yarrow Point and Hunts Point remain special exceptions (link). Their residents do not pay for and do not have library access as a result of 1991 votes by their residents (link).

At city budget meetings over the last six months, residents have asked about opting out of the library. There’s no precedent I could find for a city opting out of the library system.

A city tax increase in 2026?

At the top of the city administration’s list of how to address the city’s financial “structural imbalance” is a large but unspecified property tax increase, known as a “levy lid lift:”

“Levy lid lift” refers to “lifting” the 1% “lid” on increases to the property tax levy. A city may ask its voters to authorize an increase of more than 1% to the property levy amount. (link)

The city’s previous mayor, back in 2023, called such a property tax hike the city’s “easiest option.” (link)

There has been relatively little public comment from residents about a levy lid lift in the absence of city communication about details and the alternative options considered and rejected. The two public comments I did find — from October 2024 (link) and March 2025 (link) — were firmly against a tax increase.

Residents can expect more details and discussion at the April 17 budget meeting.

Thank you for reading! Please feel free to share this newsletter with your friends and neighbors. If you are not already subscribed, signing up is both easy and free.

Dean Hachamovitch