Five things you should know about the current City Budget, and the one big thing that’s changing for next year.

The City Budget process began on Tuesday with the first of three public “study sessions.” Before digging into the process, here’s a brief recap of the 2021 budget that emerged from last year’s budget process:

“The Budget is balanced. There is a budgeted deficit.”

The 2021 deficit is ~$2.3m, the difference between planned expenditures of $7.6m and planned revenue of $5.3m. (More below on this.)

The City has “a structural issue” in that “expenditures are growing faster than revenues.”

The City funds the deficit from its reserves, acknowledging “The use of reserves to balance the budget is not a sustainable long-term strategy.”

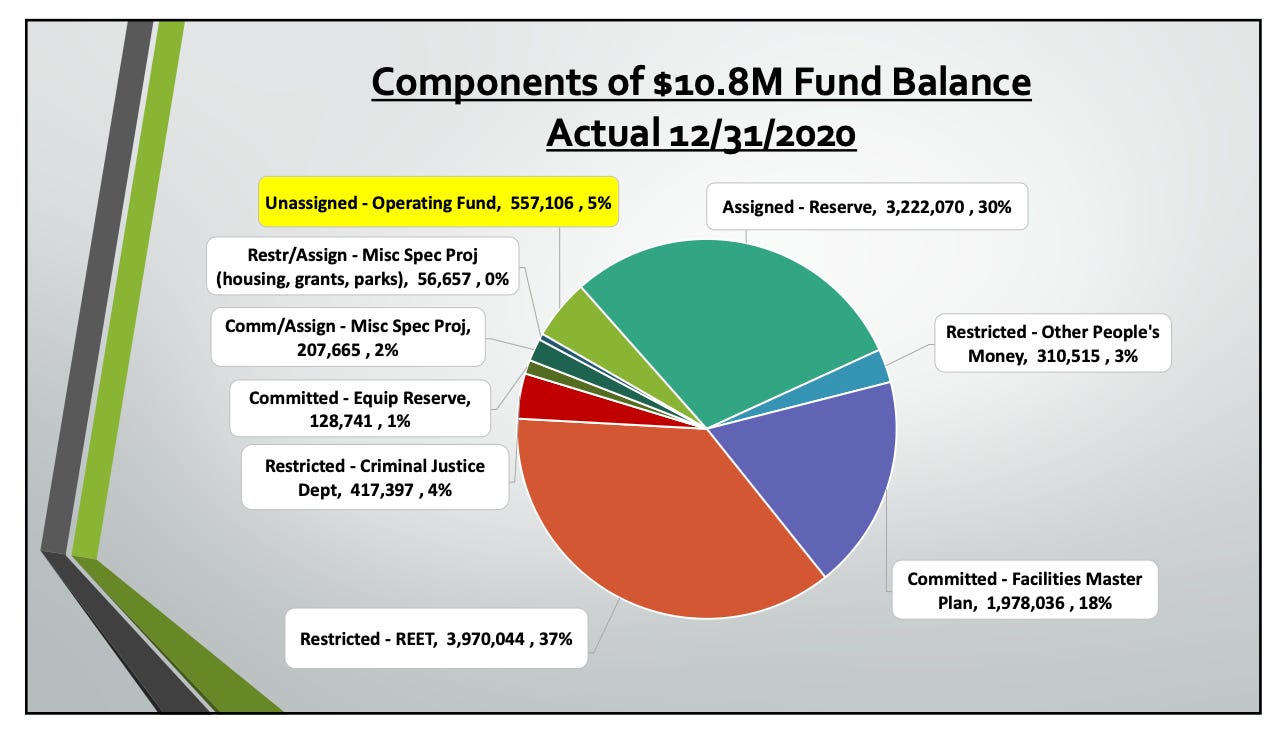

The City started the year with ~$11m of reserves, about $5.6m of which the City could use/re-deploy if needed.

You can find all this information in the 131 page budget book here. You just have to read a lot to piece it together this bluntly.1 One more thing based on the first budget study session on Tuesday and the information available from the City to date:

It’s unlikely that next year’s budget (2022) will be significantly different from this year’s (2021). Those details are still in the works.

The one recent big change for next year’s budget involves a less conservative policy around financial reserves (“buffer”).

Previously, the City’s financial policy involved using worst-case scenarios (that one councilmember described in terms of “preparing for Armageddon”). The new policy is that the City will maintain a reserve of at least 25% of the current year’s budgeted expenditure.

There is no material effect of this policy change on the actual budget. The City has more than a year’s budgeted operating expenditure in reserve already. The most likely outcome of this change, is wasting less time and energy on unrealistic projections.

Budget Big Picture: Priorities, Not Just Numbers

I think about the budget as the plan for what services the City will provide, how much the City will pay for them, and what funding sources the City will use pay to for them.

It’s really easy to think about the budget as just the numbers. The budget is about priorities and policies. How an organization or person spends their scarcest resources is a strong signal about what they value. What’s in the budget and what’s not will tell you a lot. One council member described it to me as a business plan. That works too.

The Process

The Mayor and City Staff prepare a budget and submit it to the City Council as a resolution, and the council then approves it. You can read last year’s budget ordinance here.

Residents provide input into the budget process in the form of the Budget Advisory Committee (BAC). Tuesday’s meeting involved all these groups: BAC, Mayor & Staff, and City Council. There are three public “study sessions” (Tuesday’s meeting, and additional ones in September and November) en route to the budget that Mayor and Staff submit.

Tuesday’s meeting was a discussion of the financial policies that guide the budget discussion. You can see the agenda for the meeting here and the slide deck for the discussion here. The most noteworthy change, described above, was to policy #5. The other policies convey inarguable good: who can argue against statements like “Balance all aspects of the budget for long‐term fiscal solvency”? Similarly, the City looks carefully at best practices of organizations like the Government Finance Officers Association.

The meeting was recorded; no information yet on posting that 2½ hours of discussion. Mechanically, these policy changes become official when the City Council votes on them along with the budget in December.

No, wait, go back: unsustainable deficit?

Let’s start with what’s saving us:

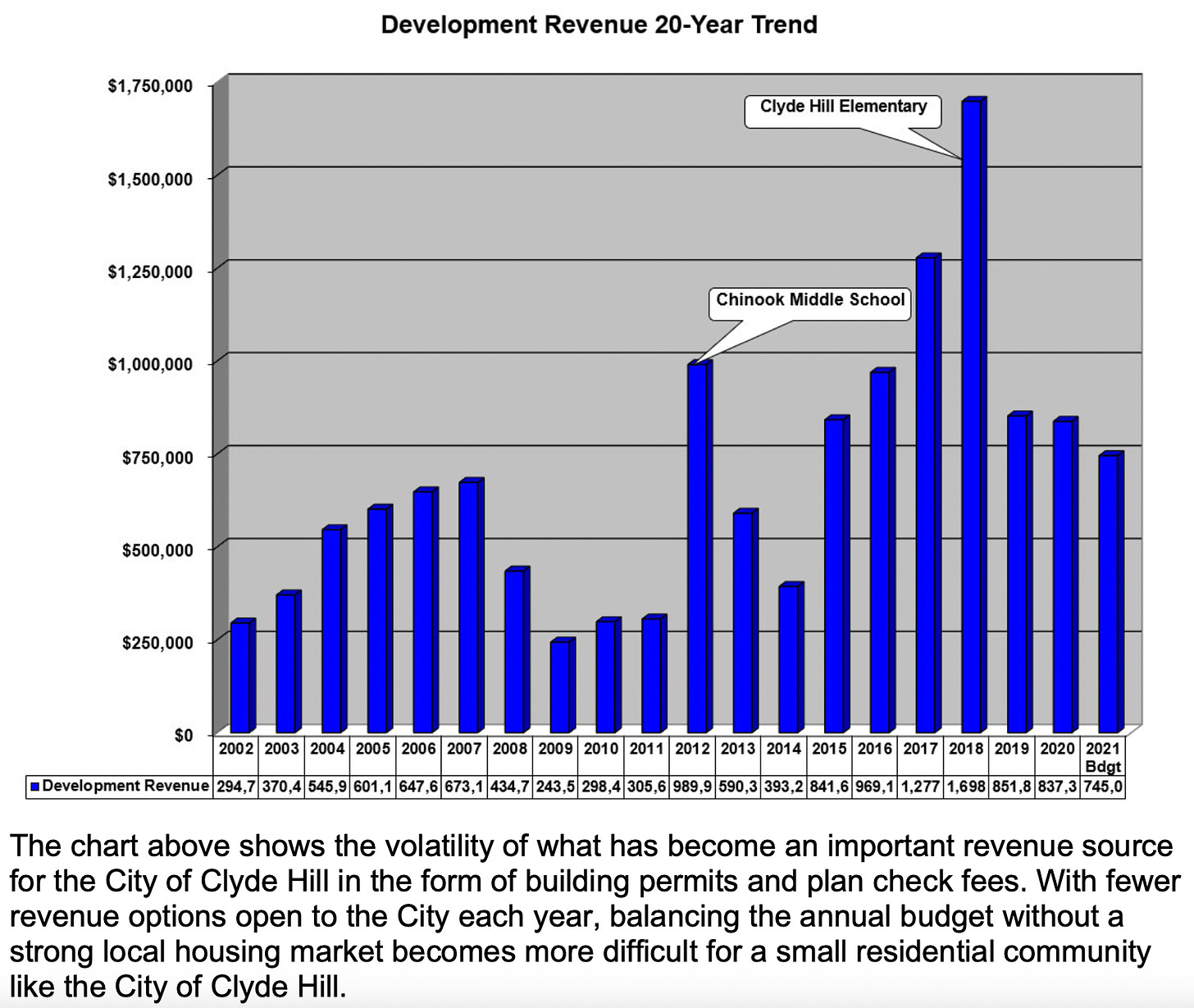

In 2012, the $40.5M Chinook Middle School project provided the City with a one-time infusion of revenue that helped pull the City out of the recession. The redevelopment of the Clyde Hill Elementary School in 2018/19 pushed development revenues into record territory. (Budget Book, page 8)

Visually:

About those record reserves that we’re using: this chart is from Tuesday’s meeting:

Now that we see we have some buffer and can avoid extreme reactions to this financial situation, let’s look at the “structural issue” that results in “expenditures are growing faster than revenues.” Here’s an illustrative example:

property taxes are allowed to grow only 1% per year while the local Consumer Price Index (CPI-W) tends to grow faster. Last year CPI-W grew at a rate of 1.7%. Salaries and many contracts are linked to CPI-W. (Budget Book, page 7)

Is it really that bad?

Maybe? In effect, part of the budget is a placeholder: there’s a large sum allocated to the Facilities Master Plan that has gone unspent (“as it has for years,” according to a long-time City watcher).

The City isn’t yet rapidly burning through its reserve. And the actual plan is just not clear, so there is no understanding it.

The gap in operating expenditures is relatively small, less than $300K.

What can we do?

The first and most important thing to do is be clear and upfront about the situation. Please look at communications from the City about finances and consider: do you think they’re communicating clearly enough? Responsive and accountable government happens only if residents have clear, honest communication.

The basic alternatives are what you’d expect:

Reduce service levels. Likely we could make some progress here (especially given some recent City decisions), even if it’s not enough to make up the gap. I haven’t seen evidence that we’ve done all we can do here.

Reduce the cost of current service levels. Again, could help make some progress but not all of what’s needed. Small cities don’t benefit from scale the way larger cities do. Clyde Hill and Yarrow Point already share the cost of police, just as Medina and Hunts Point do. I haven’t seen evidence that we’ve explored this path.

Generating more revenue. There are a lot of ways to raise taxes. The City has already restored a 1% increase in property taxes, the maximum allowed by law. Medina passed a “levy lid lift” to increase taxes more than that; there is also “banked capacity.” Every utility bill you pay has taxes that go to Clyde Hill. Another approach involves making remodels and new construction more expensive, likely to have a great impact on new residents.

What do you think and what do you suggest?

References: “The Budget is balanced. There is a budgeted deficit.” (page 4); deficit of ~$2.3m from planned expenditures of $7.6m and planned revenue of $5.3m (page 19); “a structural issue” in that “expenditures are growing faster than revenues.” (page 2); “The use of reserves to balance the budget is not a sustainable long-term strategy.” (page 2); ~$11m of reserves with $5.6m the City could use/re-deploy if needed. (Page 29 & Tuesday’s meeting).