Clyde Hill News: Record deficit in city’s “first draft” of 2026 budget

Residents invited to March 25th public meeting to consider options

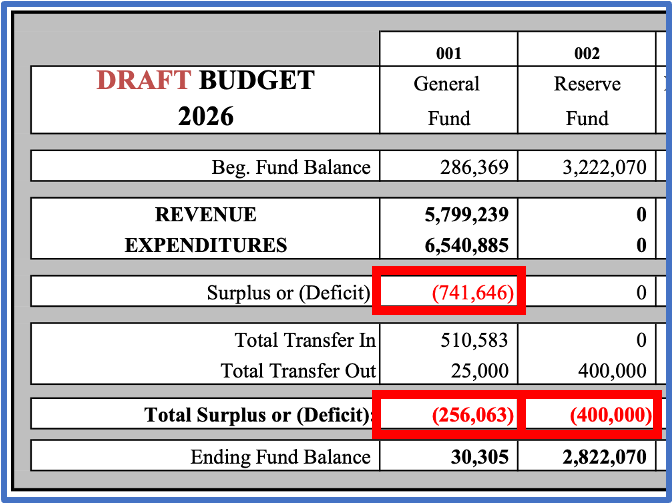

The city’s “first draft” budget for 2026 has a record deficit of $256K, according to documents the administration posted on the city’s website late last week.

The city will hold a public meeting on Tuesday, March 25th, at 4:00 PM to discuss “decision package options” to reduce the city’s projected operating deficit. At the top of the list of how to address the city’s financial “structural imbalance” is a large but unspecified property tax increase, known as a “levy lid lift:”1

In an apparent first, the proposed budget includes a transfer from the city’s Reserve Fund (“rainy day fund”) to cover part of the $742K gap between General Fund expenditures and revenues (link).

The city could, in theory, spend more of its reserves to further reduce this deficit.2

Below, two perspectives — how this plan represents progress worth celebrating, and why some residents might expect more progress and specifics — and information on attending the meeting and providing public comment.

Disclaimer: while I am a council member on the Clyde Hill City Council, I write this newsletter in my capacity as an individual resident. Any opinions expressed are my own and not necessarily the position of the city. City information and references here are from public sources. I welcome email responses — and if the topic is about city business I will respond from my city email account.

Celebrating progress

The first draft of the budget is available to residents six months earlier than it was last year (link), providing more time for discussion and public scrutiny. This is progress worth celebrating.

The city has also increased its engagement with the community. Public meetings with residents started months earlier than in past years (link), and the city has sent several emails to residents and made several social media posts about the budget process. Again, progress worth celebrating.

Tuesday’s meeting will also include several specific “decision package options” to reduce the city’s projected operating deficit, including forming a stormwater utility and sharing services with neighboring communities. A document included in the packet provides details on these options (link) for residents.

Expecting more

Residents who engaged in the city’s budget process from October through December 2024 have described a sense of déjà vu.

For example, many of the same questions and ideas from the last three months of 2024 have been repeated during the first three months of 2025.

Residents have expressed an expectation of clearer answers, more specifics, and more progress given all the time that residents put in to budget meetings last year.

Complicating matters further are debates and disagreements about facts, as well as growing frustration about communication and follow-through. This excerpt from a resident’s public comment (via email) at the March council meeting earlier this month is a good example:

I think it is important to publicly refute what I consider to be a false statement that was in the written document that the Mayor wrote and read at the 2/25/25 Special Council Meeting. The statement was as follows (highlight added):

• Allegations of unresponsiveness to resident inquiries are unfounded. It was agreed that recent complex budget-related inquiries would be addressed through the work of the Financial Sustainability Task Force….

I have never received any response to my direct question that has now been asked for not once, not twice, but three times which is why I find the comment by the Mayor to be so disingenuous.

The resident added:

I have written twice before, “either prove that my facts are wrong, prove with facts that the analysis and conclusions I have drawn are wrong, or fix the problem.”

You can read the entire public comment here: link.

Attending the meeting and providing public comment

Residents can attend the meeting at City Hall at 4:00 PM on March 25th. Information on how to attend virtually is available here: link. The full agenda and meeting packet is available here: link.

A reminder that the meeting agenda includes the opportunity for public comment. You can also reach your elected officials via email to provide public comment in advance at these addresses:

"Mayor Friedman" <Mayor@clydehill.org>; "Councilmember Wissner-Slivka" <council1@clydehill.org>; "Councilmember Sinwell" <council2@clydehill.org>; "Councilmember Andonian" <council3@clydehill.org>; "Councilmember Olson" <council4@clydehill.org>; "Councilmember Hachamovitch" <council5@clydehill.org>

Thank you for reading! Please feel free to share this newsletter with your friends and neighbors. If you are not already subscribed, signing up is both easy and free.

Dean Hachamovitch

What is a “levy lid lift?”

Levy. What residents think of as “property tax” is actually a “levy.” The city council approves an annual property tax levy, “certifying the amount of taxes to be levied” on behalf of the city. (link)

Lid. State law places a limit or a “lid” of 1% on how much a city can increase its property tax levy every year. (link)

Lift. To increase the property tax by more than 1%, a city may ask voters to “lift” the “lid” on the “levy” and “authorize an amount that exceeds the levy limit.” (link)

There are two deficits (or potential surpluses) in the budget:

The gap between revenues and expenditures. In this proposed budget, there’s a “gross” deficit of ~$742K.

The “Total Deficit” after transfers in and out of a fund are taken into account. In this proposed budget, $400K from the Reserve Fund and $111K from the City Street Fund decrease the deficit from $742K to $231K, and the $25K transfer to the Equipment Replacement fund increases the deficit to ~$256K.

The city’s professionals treat “Total Deficit” (e.g. slide 5 here, link) as “the” deficit. Residents at public budget meetings in the last three months of 2024 expressed concerns about masking the problem using one-time revenues (like the 2021 American Rescue Plan Act funds).